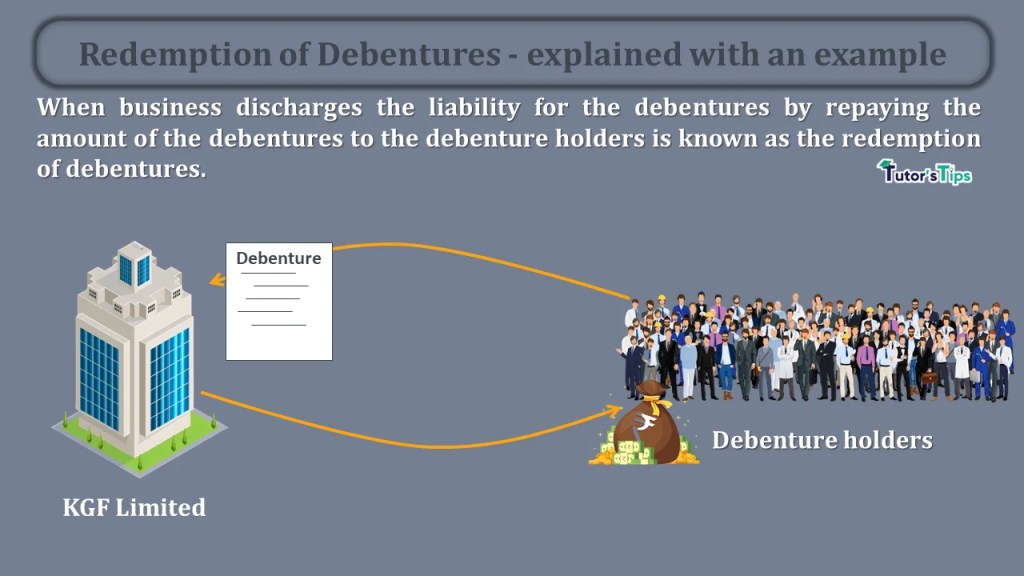

Redemption of Debentures explained with an example Tutor's Tips

What is Redemption in Mutual Fund? The process of withdrawing units with an aim to gain your returns from the funds is the definition of mutual funds redemption. This enables you to enjoy the benefit of the redemption of a mutual fund as you receive funds in your account very soon. There are times when there is a need to withdraw or liquidate.

Redemption of Debentures Meaning and Methods

Redemption is the process of making a monetary withdrawal from a mutual fund, at the net asset value prevailing on that day. All that is needed is for the investor to fill out a form to request.

PPT BONUS SHARES PowerPoint Presentation, free download ID5791525

Redemption is a fundamental concept in finance and business that plays a crucial role in managing investments and obtaining liquidity. By understanding the meaning and importance of redemption, individuals and businesses can make informed decisions and navigate the complex world of finance with confidence. So, the next time you come across the.

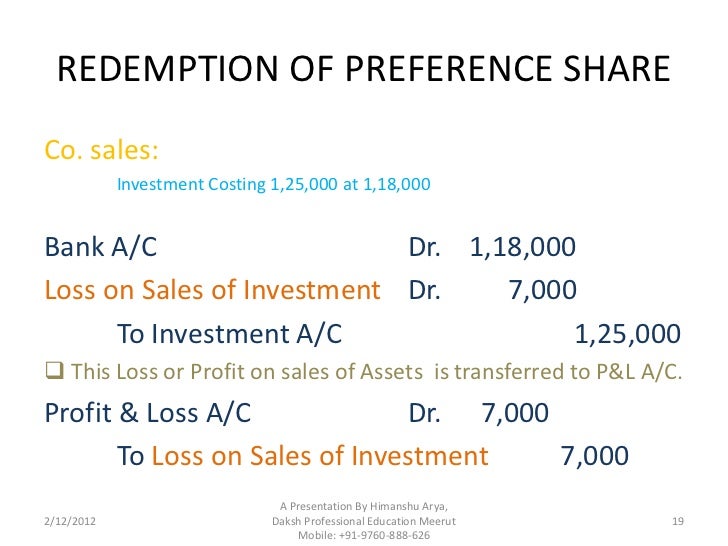

3 Redemption of redeemable preference share financial accounting sem1 part 3 YouTube

In finance, redemption refers to the repayment of any fixed-income security at or before the asset's maturity date. Bonds are the most common type of fixed-income security, but others include certificates of deposit (CDs), Treasury notes (T-notes), and preferred shares. Another use of the term redemption is in the context of coupons and gift.

PPT The Scheme Of Redemption PowerPoint Presentation, free download ID3137091

The time value of money (TVM) is the concept that the money you have in your pocket today is worth more than the same amount would be if you received it in the future because of the profit it can.

Redemption Definition in Finance and Business

:max_bytes(150000):strip_icc()/making-money-with-mutual-funds-for-retirement-170141153-b7b6e56701b04c9c9272e9cd90734b53.jpg)

Redemption 1. In bonds, the act of an issuer repurchasing a bond at or before maturity. Redemption is made at the face value of the bond unless it occurs before maturity, in which case the bond is bought back at a premium to compensate for lost interest. The issuer has the right to redeem the bond at any time, although the earlier the redemption take.

PPT Redemption of preference shares II PowerPoint Presentation, free download ID5467631

Redemption: A redemption is the return of an investor's principal in a fixed-income security, such as a preferred stock or bond, or the sale of units in a mutual fund . Fixed-income securities are.

Redemption Of Debentures Meaning, Types and DRR

Used-car rates were even higher: The average loan carried an 11.9 percent rate in March, up from 11.4 percent in the same month in 2023 and 8.1 percent in 2022. Car loans tend to track with the.

Redemption of preference share

Redemption in finance is paying back a fixed-income asset on or before its maturity date. The most popular fixed-income investment is a bond, although there are also CDs, treasury notes, and preferred stocks. Types of Redemption Cash is the most preferred form of redemption.

Debenture Redemption Reserve (DRR) Accounting Entries Tutor's Tips

Redemption is paying back the principal amount of financial securities such as stocks, bonds, mutual funds, etc. to the investor with investment amount and any gain made on the investment. The redemption that is repayment of any fixed income securities is done either before or at the time of maturity date. Investors can ask for partial or full.

The creation and redemption mechanism of ETFs!

Understanding the Concept of Redemption Price. At its core, redemption price refers to the price at which an investment, such as a bond or mutual fund, can be redeemed or repurchased by the issuer. It represents the value that an investor will receive upon the maturity or sale of their investment.

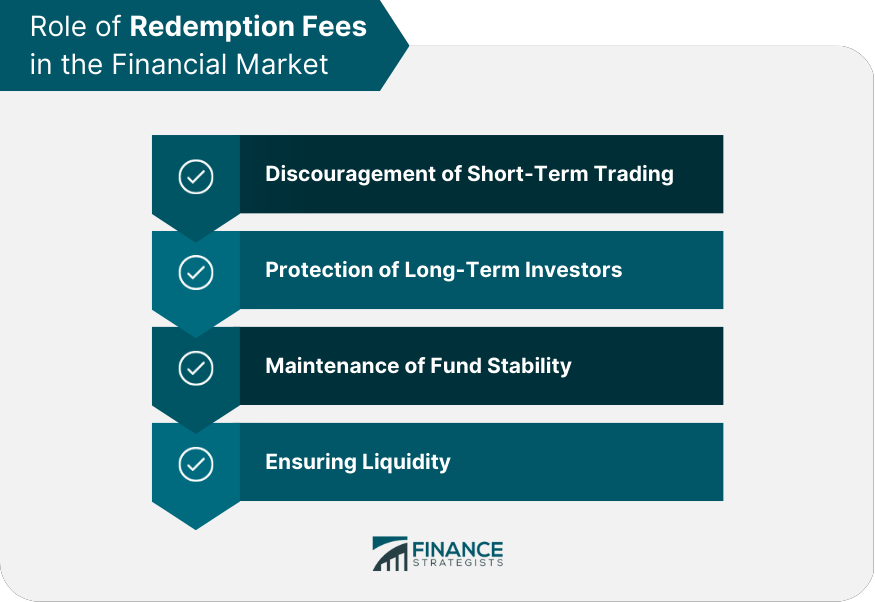

Redemption Fees Definition, Role, Calculation, and Impact

Redemption in finance involves repaying fixed-income securities, such as bonds, on or before their maturity date. Callable bonds offer issuers the option to redeem bonds before maturity. Mutual fund redemptions require investors to inform their fund manager, with funds disbursed at market value. Redemption of coupons and gift cards is a common.

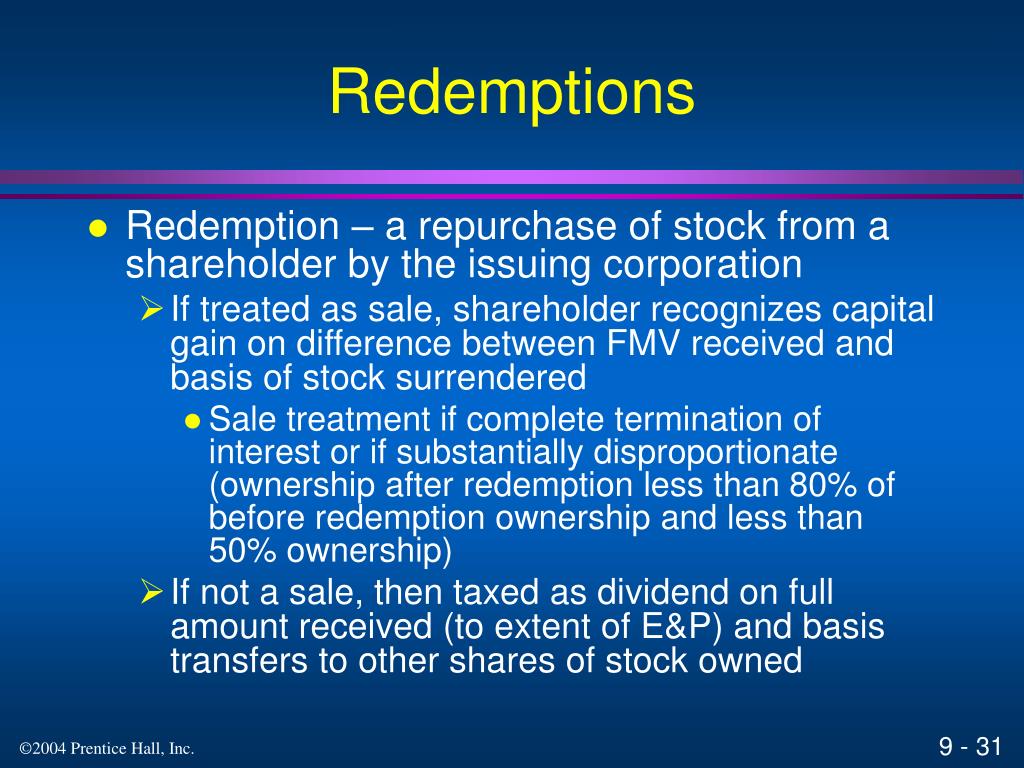

PPT Taxation of Corporations PowerPoint Presentation, free download ID528621

A redemption fee is a charge that an investment fund or financial institution may impose when an investor sells or redeems their shares within a specific time frame, typically a few months. The fee is intended to discourage short-term trading and compensate for the administrative costs associated with the redemption.

Issue and Redemption of LongTerm Liabilities PDF Bonds (Finance) Interest

Redemption. 1. In bonds, the act of an issuer repurchasing a bond at or before maturity. Redemption is made at the face value of the bond unless it occurs before maturity, in which case the bond is bought back at a premium to compensate for lost interest. The issuer has the right to redeem the bond at any time, although the earlier the.

Investment Management Gross Redemption Yield!

Gross redemption yield and net redemption yield are two financial calculations that can help you calculate the rate of return on your investments. Typically, redemption yields are used in debt.

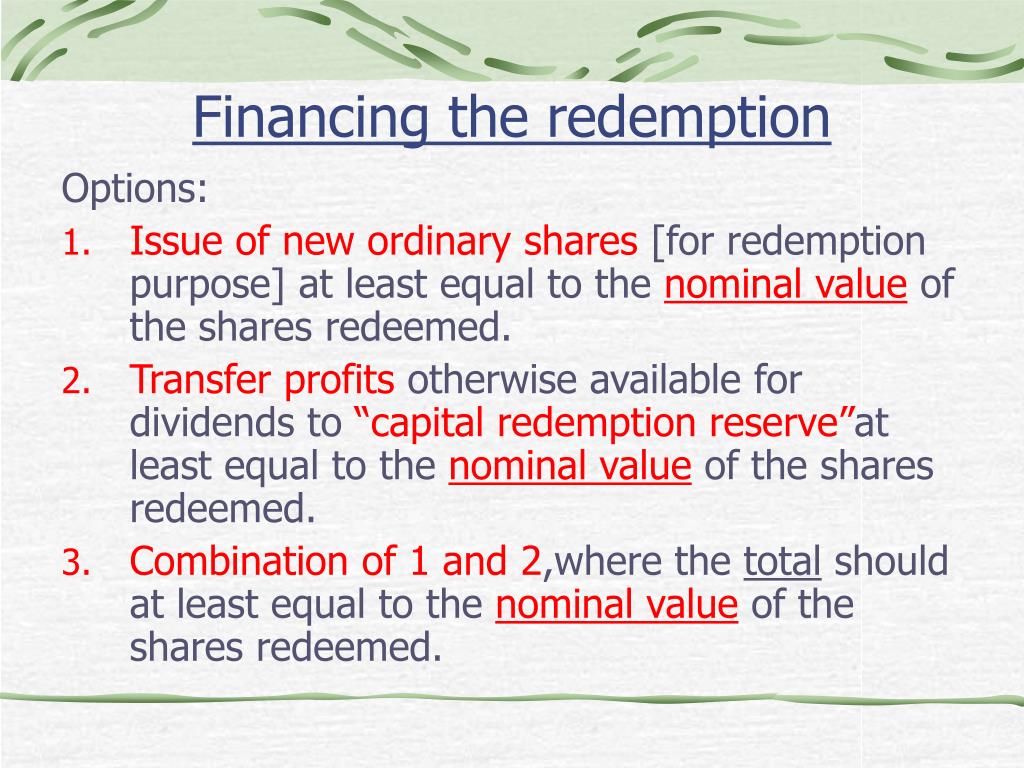

PPT TOPIC 4 REDEMPTION OF SHARES PowerPoint Presentation, free download ID6880753

Redemption is the process of selling or exchanging an investment, typically for cash. In this article, we will explore the key concepts and strategies for redemption in the world of finance. Learn how to make informed decisions about when to redeem your investments and how to maximize your return.