PPT LECTURE 6 DYNAMIC INCONSISTENCY OF POLICY, AND HOW TO ADDRESS IT PowerPoint

To see the time-inconsistency problem here, consider a democratically elected government. All else equal, officials have an incentive to provide more resources to their constituents through spending and transfers, but doing so requires financing.. By handing the power to set monetary policy over to an independent central bank, the government.

Solved 1. To solve the "time inconsistency" problem in macro

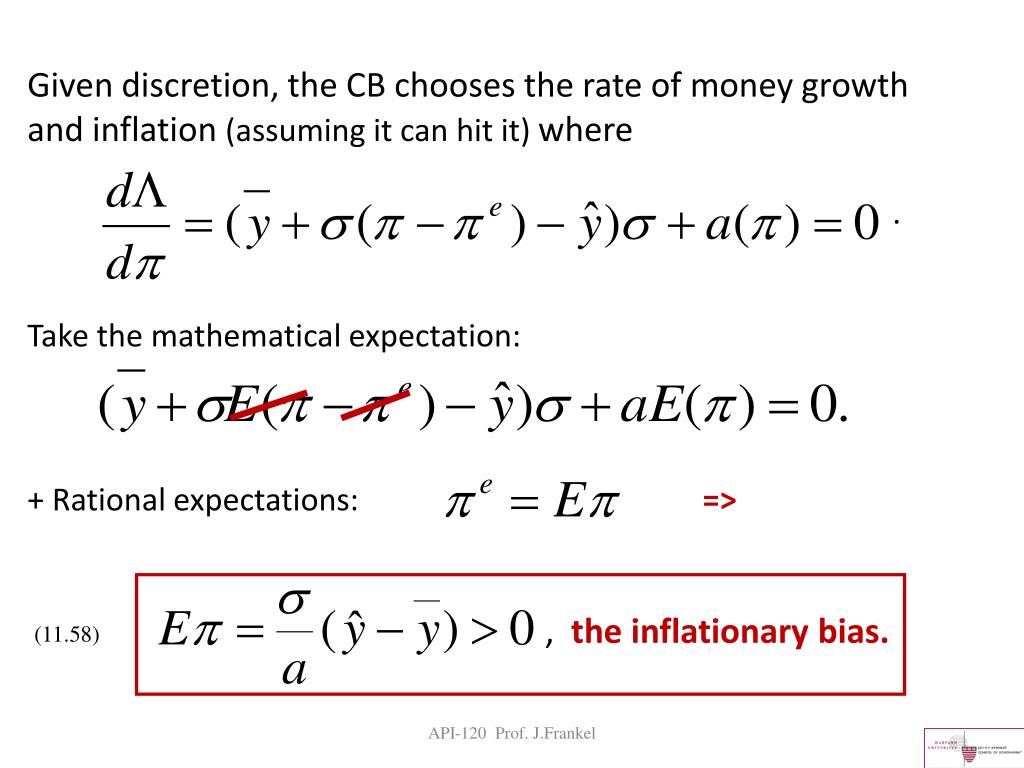

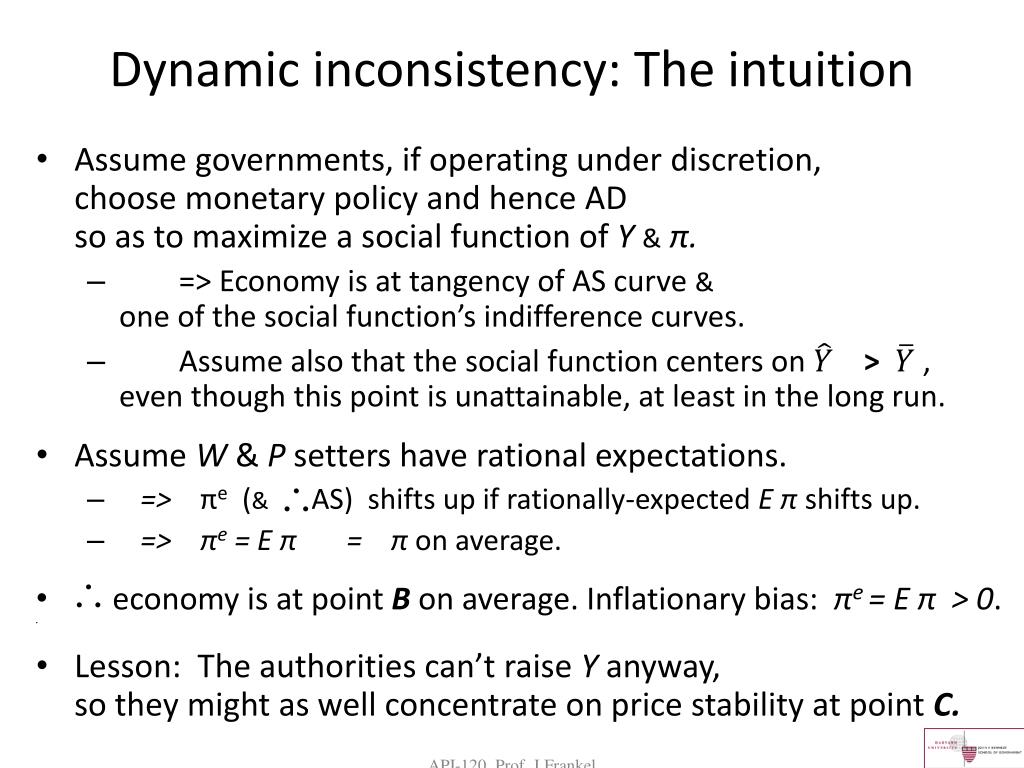

optimal policy time consistent, or at least bring the time-consistent solution closer to the second-best optimum. In monetary policy, a key early contribution is Barro and Gordon (1983). In an environment with an expectations-augmented Phillips curve, it shows, using the well-known Time Consistency of Monetary and Fiscal Policy 3

PPT Policy Goals, Strategy, Tactics PowerPoint Presentation ID1126602

dates to overcome the time-inconsistency problem. To do this we calculate optimal monetary policy in a New Keynesian model of a small open economy, as in Gali and Monacelli (2005) or de Paoli (2009). We first show that both single mandates result in a significant welfare

PPT LECTURE 6 DYNAMIC INCONSISTENCY OF POLICY, AND HOW TO ADDRESS IT PowerPoint

The time-inconsistency problem arises in the context of monetary policy, because there is a temptation to give a short-run boost to economic output and employment by pursuing a course of policy that is more expansionary than firms or workers had initially expected. 5 Nevertheless, if the economy is already at full employment, then this boost is.

Time inconsistency in recent policy CEPR

Setting tax policy is an area where time inconsistency can be a problem. It has been discussed in detail by Rogers (1987). Her analysis is interesting for two reasons. Firstly, the efficiency consequences of time inconsistent tax policy are very significant given the important role played by tax rates in so many decisions.

PPT LECTURE 6 DYNAMIC INCONSISTENCY OF POLICY, AND HOW TO ADDRESS IT PowerPoint

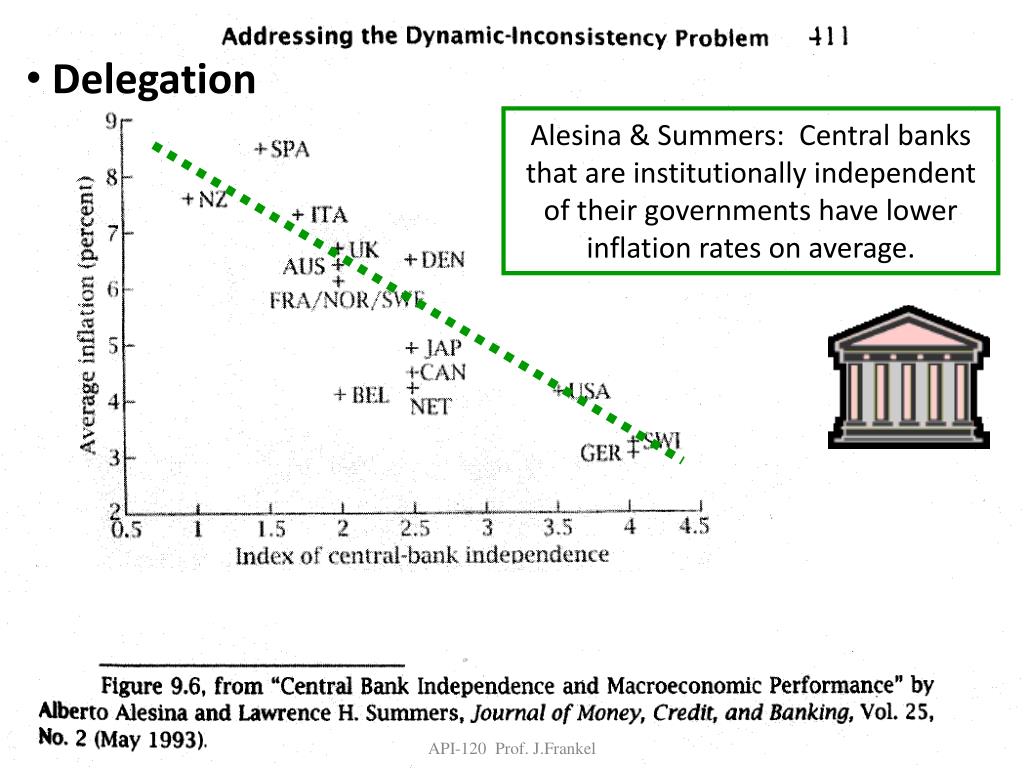

time inconsistency problem of monetary policy.3 Among the most prominent proposals is the delegation solution suggesting the government hand over the sole responsibility of monetary policy to an independent central bank. By doing so an additional principal-agent relationship evolves between the gov-

PPT LECTURE 6 DYNAMIC INCONSISTENCY OF POLICY, AND HOW TO ADDRESS IT PowerPoint

In these models, monetary policy is made by a benevolent policymaker who cannot commit to future policies. The study defines and analyzes Markov equilibrium in these economies and shows that there is no time-inconsistency problem for a wide range of parameter values.

Discretionary Policy and Time Inconsistency Free Essay Example

the time-inconsistency problem and are, indeed, extremely averse to falling into a time-inconsistency trap. However, even if central bankers recognize the problem, there still will be pressures on the central bank to pursue overly expansionary mone-tary policy by politicians. Thus, overly expansionary monetary policy and inflation may result.

Policy and Time Inconsistency Pt. II YouTube

A new departure in the study of time consistency of monetary policy is the consideration of the role of sticky prices. This introduces a new channel through which time inconsistency may arise: when prices are sticky and firms are bound to produce whatever is demanded at the given price, a surprise monetary expansion raises output.

Policy and Time Inconsistency YouTube

The time consistency problem has become a standard ingredient in subsequent research on economic policy. First introduced by Kydland and Prescott in 1977, "Rules rather than Discretion: The Inconsistency of Optimal Plans". Let's look at the Nobel prize description of this work: Time-consistent Policy. In the late 1950s and early 1960s.

The time inconsistency of policies and its effect on the exchange rate fluctuation in Iran

But having promised a tight monetary policy, and having secured lower inflation today, the central banker now has less incentive to implement the promised tight policy in the future.. "Does the Time-Inconsistency Problem Explain the Behavior of Inflation in the United States?" Journal of Monetary Economics 44(2), pp. 279-291. Kydland, F.

PPT LECTURE 6 DYNAMIC INCONSISTENCY OF POLICY, AND HOW TO ADDRESS IT PowerPoint

1.2 Time inconsistency and policy There are hardly any scientific publications in economics that had as important an impact on day-to-day policy-making as the contribution of Kydland and Prescott. Soon after identifying the inherent time inconsistency problem of optimal policy plans with rational expectations, similar problems were

PPT LECTURE 6 DYNAMIC INCONSISTENCY OF POLICY, AND HOW TO ADDRESS IT PowerPoint

1.2 Solutions to the classical time-inconsistency problem. The proposed solutions can be grouped into reputational solutions, delegation solutions and contract solutions. A. Reputation The analysis above rests on an assumption that the game between the policy maker and the private sector is a one-shot game.

PPT LECTURE 6 DYNAMIC INCONSISTENCY OF POLICY, AND HOW TO ADDRESS IT PowerPoint

An example from Daniels and Vanhoose (1998): Rogoff's paper makes one of the most fundamental points about policy coordination: In the presence of time inconsistencies, monetary policy coordination is not necessarily welfare improving. macroeconomics. monetary-policy. equilibrium-selection.

PPT Stabilization Policy PowerPoint Presentation, free download ID5640585

To overcome the problem of time inconsistency, some economists suggested that policymakers should commit to a rule that removes full discretion in adjusting monetary policy. In practice, though, committing credibly to a (possibly complicated) rule proved difficult.. Monetary policy has an important additional effect on inflation through.

PPT LECTURE 6 DYNAMIC INCONSISTENCY OF POLICY, AND HOW TO ADDRESS IT PowerPoint

While the basic model of time inconsistency, put forward by Barro and Gordon (Barro, R. J., & Gordon, D. B. (1983). Journal of Political Economy, 91, 589-610) is widely accepted now, several authors have expressed serious doubts about the empirical relevance of the model in explaining inflation. Interestingly enough, few attempts have been made so far to test for the existence of.